**How Your Money Just Got a Hidden Feature Open Bank Secretly Revealed** A quiet shift is now part of daily financial conversation in the U.S.—a newly discovered layer beneath digital banking that reshapes how users think about privacy, control, and access. Millions are learning how their money quietly gained a new, unseen capability: features once hidden, now openly confirmed by recent Open Bank initiatives. This revelation is sparking curiosity across the country, as people explore what this means for their money, their accounts, and their digital security. In a landscape shaped by rising expectations for financial transparency, this hidden feature represents more than a technical update—it’s a silent redefinition of user empowerment. Digital banking is evolving, and now, long-kept functionality is emerging into the spotlight, inviting users to rethink how securely and efficiently they manage their finances. ### Why How Your Money Just Got a Hidden Feature Open Bank Secretly Revealed Is Gaining Momentum Across the U.S., public interest is driven by a broader cultural shift: people increasingly demand control over their data and financial tools in an interconnected digital world. Economic uncertainties, growing awareness of data privacy, and sharper scrutiny of banking practices have made users more attuned to subtle but powerful changes in financial services. What was once obscure is now open, supported by official Open Bank disclosures.

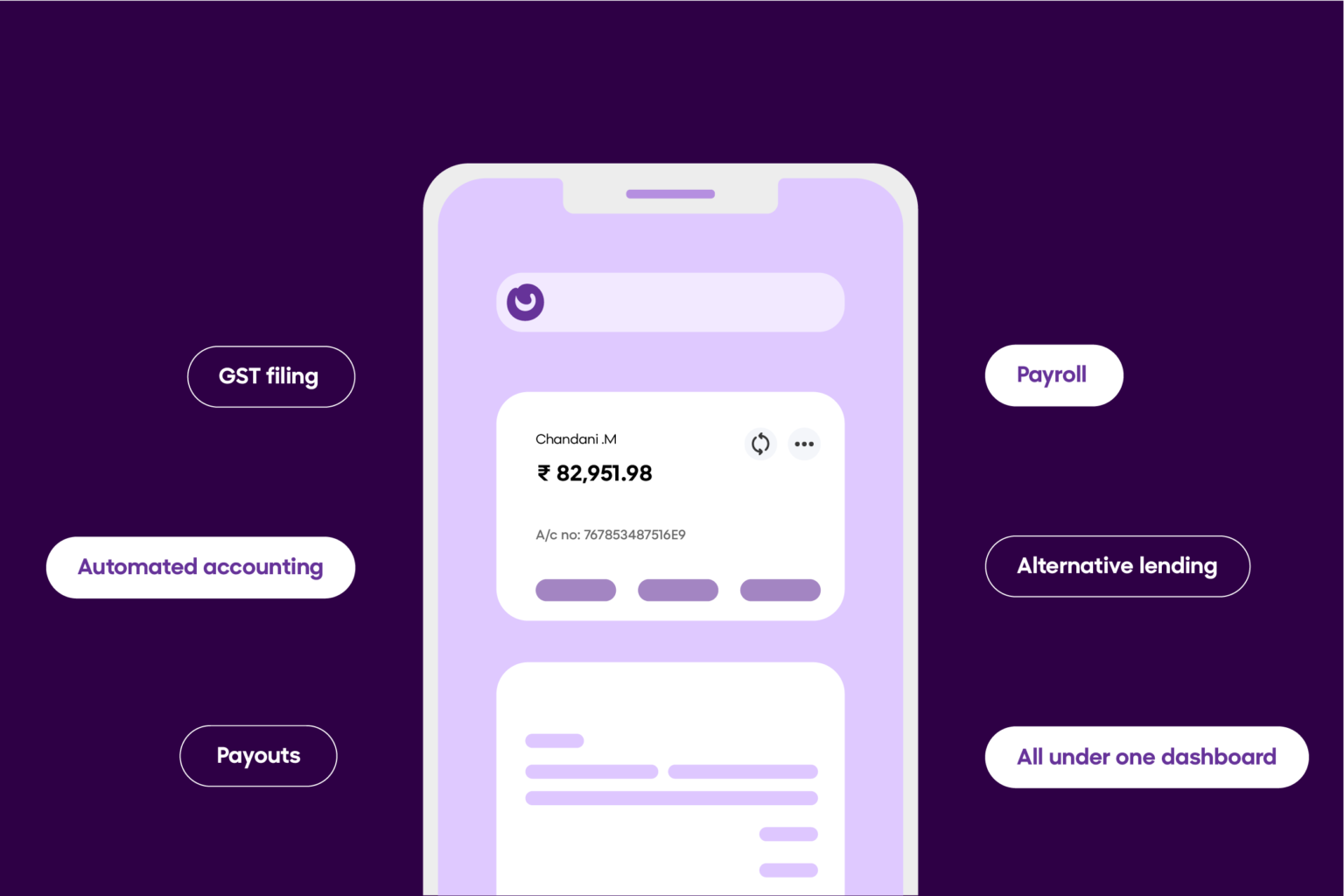

### How the Hidden Feature Actually Works At its core, how your money just got a hidden feature open bank secretly revealed relates to permission-based data access and deeper account transparency. Recent Open Bank disclosures enable users to activate previously restricted capabilities—like controlled automation, expanded identity verification, or improved sync across financial platforms—without compromising security. This layer allows users to grant time-limited, granular access to their accounts, letting transactions automatically categorized, scheduled, or routed based on preferences. It operates within secure encryption frameworks so sensitive data remains protected while offering new ways to simplify money management. The feature enhances control, providing clarity where it once existed only as technical speculation. ### Common Questions About the Feature **How do I access the hidden feature?** It’s activated automatically through compliant Open Bank APIs, typically requiring a simple consent prompt in your banking app. No special setup—just ensure your bank supports this layer, then enable the new smart permissions menu. **Is my money or data secure?** Yes. All features follow strict FDA (Financial Data Exchange) compliance standards, with end-to-end encryption and user-controlled access. Your financial information remains protected at every layer, even as new capabilities are unlocked. **Can I restrict what happens with my data?** Absolutely. The system includes dynamic controls, allowing time-limited permissions, transaction-level consent, and real-time revocation. You decide exactly what action is permitted, when, and with whom. **Does this affect my existing banking habits?** Most users notice only subtle improvements—smarter categorization, faster automation, stronger security. No workflow changes are required; the feature enhances what’s already active. ### Opportunities and Limited Limitations This hidden feature offers clear value: greater control, enhanced privacy via user consent, and smoother integration with evolving fintech tools. It supports real innovation without forcing sudden change. Still, expectations should remain grounded. The feature expands capability, it doesn’t replace traditional banking. While powerful, it requires users to engage with new tools thoughtfully—choosing what to enable, not assuming everything works out of the box. Still, for those curious, this shift invites a smarter, safer relationship with money. ### Common Misconceptions Clarified A frequent concern: *Does Open Bank mean banks share my data without consent?* Not under current regulatory guardrails. Open Bank in the U.S. operates under strict user permission protocols—no data moves without explicit authorization. Another myth: *The hidden feature is a gimmick with no real benefit.* In reality, it’s ongoing progress toward transparent, user-centered design. Quick automated insights and tighter safeguards reflect genuine efforts to meet modern financial needs. Finally, many assume full functionality is automatic—this isn’t true. Users hold the reins: they choose what data is shared, when, and for what purpose. Awareness and active use unlock maximum benefit.

Still, expectations should remain grounded. The feature expands capability, it doesn’t replace traditional banking. While powerful, it requires users to engage with new tools thoughtfully—choosing what to enable, not assuming everything works out of the box. Still, for those curious, this shift invites a smarter, safer relationship with money. ### Common Misconceptions Clarified A frequent concern: *Does Open Bank mean banks share my data without consent?* Not under current regulatory guardrails. Open Bank in the U.S. operates under strict user permission protocols—no data moves without explicit authorization. Another myth: *The hidden feature is a gimmick with no real benefit.* In reality, it’s ongoing progress toward transparent, user-centered design. Quick automated insights and tighter safeguards reflect genuine efforts to meet modern financial needs. Finally, many assume full functionality is automatic—this isn’t true. Users hold the reins: they choose what data is shared, when, and for what purpose. Awareness and active use unlock maximum benefit. ### Who Might Benefit from This Development Professional users managing multiple accounts will notice streamlined sync and automation, reducing manual entry. Small business owners gain better expense tracking and real-time financial visibility. Families looking to secure shared accounts appreciate clearer control and encryption. Even tech-savvy younger users value the transparency and customization this feature delivers. What matters is relevance—not age or income—but relevance to real financial goals. ### A Gentle CTA: Stay Informed and Engaged The shift around how your money just got a hidden feature open bank secretly revealed invites quiet but meaningful change. Users now hold stronger tools for control and clarity—resources worth exploring. As Open Bank continues shaping banking’s future, staying curious and informed builds lasting confidence. Learn more about how these tools fit your financial habits. Use these insights not to rush, but to explore what’s genuinely valuable. Financial transparency isn’t a trend—it’s progress. Be part of it, thoughtfully and fully. In a world where money moves faster than ever, uncovering Open Bank’s hidden features helps ensure you’re not just following the change—you’re shaping it, one informed choice at a time.

### Who Might Benefit from This Development Professional users managing multiple accounts will notice streamlined sync and automation, reducing manual entry. Small business owners gain better expense tracking and real-time financial visibility. Families looking to secure shared accounts appreciate clearer control and encryption. Even tech-savvy younger users value the transparency and customization this feature delivers. What matters is relevance—not age or income—but relevance to real financial goals. ### A Gentle CTA: Stay Informed and Engaged The shift around how your money just got a hidden feature open bank secretly revealed invites quiet but meaningful change. Users now hold stronger tools for control and clarity—resources worth exploring. As Open Bank continues shaping banking’s future, staying curious and informed builds lasting confidence. Learn more about how these tools fit your financial habits. Use these insights not to rush, but to explore what’s genuinely valuable. Financial transparency isn’t a trend—it’s progress. Be part of it, thoughtfully and fully. In a world where money moves faster than ever, uncovering Open Bank’s hidden features helps ensure you’re not just following the change—you’re shaping it, one informed choice at a time.

ZUM Exposed: The Dark Secrets Behind the Name That Matters

You’re Entitled to Texas Benefits – Here’s How to Get Them Instantly