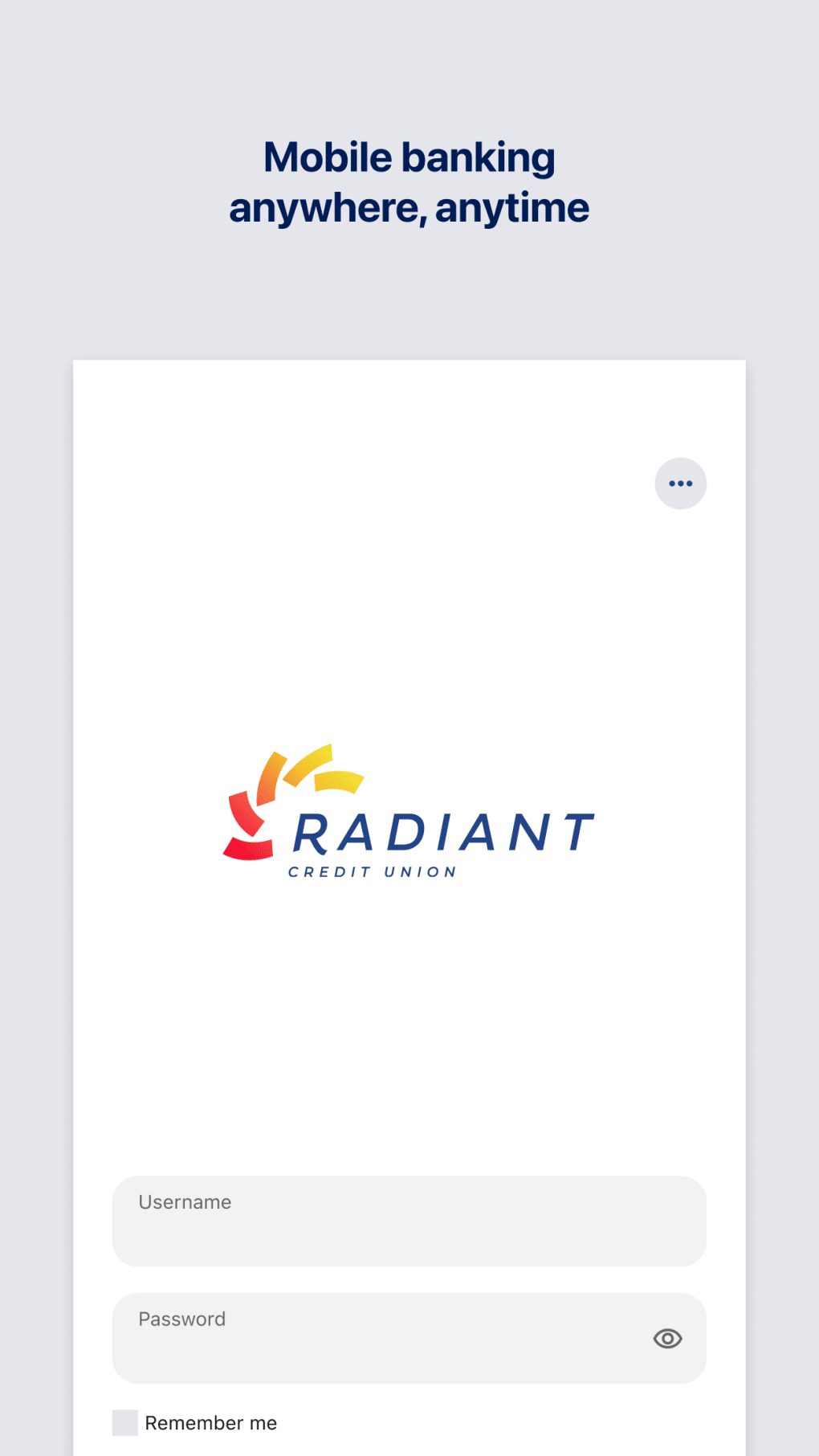

**Radiant Credit Union: The Credit Union With a Radiant Touch No One Talks About** In a financial landscape increasingly shaped by transparency, member-centric service, and quiet innovation, one credit union is quietly redefining what it means to belong. Radiant Credit Union: The Credit Union With a Radiant Touch No One Talks About isn’t loud—it’s steady. It’s the growing quiet confidence in community, thoughtful service, and a digital presence that feels more human than transactional. For readers exploring smarter, more authentic ways to manage their finances, this growing reputation matters. At a time when trust in banking institutions remains fragile and digital experiences feel impersonal, Radiant Credit Union stands out through consistent, purpose-driven engagement. The phrase “radiant touch” captures more than marketing flair—it reflects a commitment to visibility, warmth, and clarity in every interaction. This isn’t just about loans and accounts; it’s about a financial partner that looks beyond spreadsheets to understand real lives. Why is Radiant Credit Union gaining attention in the US financial scene? Multiple factors converge: rising interest in credit unions offering member-first values, increasing scrutiny of big banks, and a surge in digital tools that prioritize user experience. Unlike national chains, this institution thrives on local roots combined with modern connectivity—bridging tradition and innovation with thoughtful design. How does Radiant Credit Union deliver on its promise of a radiant experience? Their model centers on accessibility and education. Members benefit from intuitive online platforms, personalized financial guidance, and community-driven initiatives that foster long-term relationships. Rather than aggressive advertising, they focus on clear communication, transparent rates, and surprising but welcome touches—like proactive financial wellness tips or streamlined mobile banking that feels intuitive. These subtle yet meaningful gestures build familiarity and confidence over time.

Realistic considerations matter as well. While Radiant Credit Union offers competitive advantages in convenience and member engagement, no financial institution fits every financial story. Local branching, digital limitations in rural areas, and credit eligibility tiers all influence access—details important to explore honestly. This transparency strengthens trust far more than exaggerated claims ever could. Many assume Radiant Credit Union is a regional novelty or a fleeting trend. In reality, its growth reflects a broader shift: a demand for financial partners committed not only to profit, but to cultivating community and clarity. The “radiant touch” is less about marketing—and more about consistent, subtle care woven through every digital and in-person experience. For those curious about replacing traditional banking with a more authentic relationship, Radiant Credit Union offers a compelling alternative. It’s not about being talked about—it’s about showing up, day after day, with integrity and attention. Their quiet reputation speaks volumes, shaped by members who value honesty over hype. Becoming part of this conversation means more than visiting a website—it means understanding how服务 evolves when built on trust, and why that matters now more than ever. Whether educating yourself, seeking better financial tools, or exploring community-based banking options, Radiant Credit Union emerges as a credible player growing quietly in American financial dialogue. Stay informed. Stay engaged. Let Radiant Credit Union’s radiant presence guide your financial journey—not with noise, but with purpose.

This Zoomed-In Look at Earth Revealed Hidden Wonders From Space That Changed Everything

This Ordinary Xylophone Reveals a Shocking Secret That Changed Music Forever

You Won’t Believe What This X Master Can Unlock in You